Ready to grow your book like never before?

Sales Training Programs For Insurance Teams

Our sales training team will teach your Producers everything they need to know, say, do, and show to attract more leads, delight more clients, and win more business.

Do you feel like your agency is TRAPPED?

The team gets distracted by service and doesn’t focus on what’s priority: selling.

The financial incentives are not enough to motivate Producers to perform.

Your book has huge cross-sell potential that no one is taking advantage of.

Everyone is “super busy”, but weeks go by and you fall short of your growth goals.

You look ahead to next week’s team calendar and see blank spaces where sales appointments should be.

Sales success seems slow and accidental, with no way to predict what next quarter will look like.

Sales Training Program Overview

For insurance sales professionals, built by insurance sales professionals.

Targets every step of the client relationship journey.

Strategies to differentiate your team in the marketplace.

Techniques and tactics that help your team win more business, faster!

Practical training for Home, Auto, Commercial, Farm, Group Benefits, and Life Insurance professionals.

We Offer skill training programs that cover the following:

PROFESSIONAL INSURANCE SALES

The most extraordinary performers in every field are often those who do the ordinary activities for a long time.What often looks exceptional from the outside is really the result of applying the fundamentals.The good news for sellers is that the fundamental professional sales skills can be learned.

Learning Objectives

1) Define professionalism in the insurance sales context.

2) Present professional sales skills as necessary to sales success.

3) Equip sellers with the skills they need to deliver a professional experience.

OUTREACH/PROSPECTING

Prospecting can be painful. Is it just a numbers game? How should I source my leads? How am I supposed to break through to someone? Does cold calling actually work? What should I say to get strangers to meet with me?Answer these and all your prospecting questions in this hard hitting lead generation course.

Learning Objectives

1) Explore the outreach and prospecting options that are available to Canadian insurance professionals.

2) Present simple ways of improving prospecting effectiveness.

3) Share best practices that are found in other industries that insurance sales professionals rarely use.

TURNING PROSPECTS INTO CLIENTS

Emotion is part of every decision we make and buying insurance is no exception.But how do we create an emotional experience that gives our prospects the best chance at saying yes?In this course, we break down the components of working a sales opportunity and how to put our clients on a successful path to working with us.

Learning Objectives

1) Define each stage of a new sales opportunity.

2) Examine the necessary components of an effective needs analysis.

3) Explore different sales presentation formats.

4) Define objections and present ways of handling them.

GETTING CLIENT REFERRALS

Does asking for referrals make you cringe? Do you avoid it altogether? The truth is that most sellers rarely ask for referrals in a way that actually leads to a client bringing them one.Most of the time, the seller is simply stating that they would like one. End this practice for good!Learn the techniques to confidentally ask your clients for referrals irresistibly!

Learning Objectives

1) Examine why insurance sellers are reluctant to confidently ask for referrals.

2) Present a simple format for directly asking for a referral.

BOOK GROWERS

Your absolute best source of future sales is your existing book of business. This course helps you farm your single greatest asset: your current clients.Along with practical templates and scripts you can use for Upselling and Cross-Selling, more importantly, you will discover how to position yourself in a way that your clients will EXPECT you to sell them more and be delighted that you do!

Learning Objectives

1) Introduce the idea that current clients are the best tool for sales growth.

2) Define what a Policyholder Review Meeting is and present options for a strong an outcome-based meeting agenda.

3) Define upsell and cross-sell opportunities to grow client value.

BOOK GROWERS

This is not another generic social media influencer program. The media changes but the principles stay the same.Being famous to your niche is what the greatest salespeople of all time have prioritized. In this module, you will learn how you can do the same on a scale you feel comfortable with. No need for larger-than-life billboards, fancy online videos, or hundreds of hours creating content!Everyone has a personality that can create a following that will grow your business.

Learning Objectives

1) Define “Personal Brand” and explore what it means in both an online and offline context.

2) Introduce the idea that insurance sellers are staples in the

community and they have a responsibility to contribute to the

community’s success.

3) Demystify the LinkedIn platform.

Why H2H? Who's David?

“The worst part about selling insurance is that the only real training you get is on product…then you’re stuck trying to sell something you only half-understand to clients who don’t have the time, patience, or desire to learn something technical. It sets up the young and hungry insurance sales professional for failure.”I learned on the first day of the job that no one else in the room had planned to become an insurance seller…it just sort of happened.I had four very different lives in my insurance sales career: High-volume call center insurance representative, broker, brick-and-mortar agency associate, and sales trainer. I made every mistake you could possibly think of and paid dearly for it, but experimented my way to becoming one of the best producers in a nationally top-performing agency.After discovering what the top sales performers did in other industries to sell more and faster, I started delivering these ideas and techniques back to the insurance industry.Trainer Profile:

Personally sold Home, Auto, Commercial, and Farm Insurance at a nationally top-performing agency.

Over 1,400 producers trained since 2019.

Average 9.1/10.0 client experience score.

What are you waiting for? It's time to grow!

What Other Insurance Sales Leaders and Producers Have Said About Working with David

ATTENTION: Insurance Agency/Brokerage Owners and Sales Managers

Does Your Producer Team FAIL To Grow The Book Like You Know They Should?

Keep Reading To Learn How To Easily Compel Your Team To Become Book-Growing Machines In The Next 90 Days Without Excuses, Pissing Off Clients, Or Spending Countless Hours Begging Them To Change.

Do you feel like your agency is TRAPPED and leaving money on the table?

The team gets distracted by service and doesn’t focus on what’s priority: selling.

The financial incentives are not enough to motivate Producers to perform.

Your book has huge cross-sell potential that no one is taking advantage of.

Everyone is “super busy”, but weeks go by and you fall short of your growth goals.

You look ahead to next week’s team calendar and see blank spaces where sales appointments should be.

Sales success seems slow and accidental, with no way to predict what next quarter will look like.

You’ve already tried to train, coach, and motivate your team to do better but nothing sticks. You might get some change for a little while, but then Producers fall right back to their same bad habits.You feel STUCK having the same broken record conversations over and over again.But the good news is this: it’s not your fault.And there’s a way out of this trap.

There are 3 painful insurance industry facts that lead to the production problem.

INSURANCE INDUSTRY FACT #1

Most companies focus on products and systems training which trains producers to “think in product” and become transactional order-takers.

INSURANCE INDUSTRY FACT #2

Insurance is branded as “boring” so top sales talent look at other industries when hunting for a career.

INSURANCE INDUSTRY FACT #3

We have an identity crisis – we don’t know who we are in the marketplace, so we can’t differentiate ourselves as a high-value option.

These facts lead to our Producers promising high-quality service, but losing on price almost every time.But this doesn’t have to be your story. Not anymore.

This Is Your Call To Break Free From The Trap.

Transform your Production Team into a machine that attracts leads, delights clients, and wins more business.If you’re ready to become the agency leader you were born to be, this may be your fastest path to:

Growing your book.

Motivating your people.

Sailing into retirement with a legacy you are proud of.

Sales research of over 2,500,000 salespeople and their managers shows that there are 3 major sales management blind spots that get in between you and achieving the outcomes you want.

Agency Management

Blind Spot #1 – Coaching

Are you coaching your people enough?A focused study of 11,078 salespeople and their managers found that “any amount” of coaching is better than none. No surprises there. Going from “none” to “some” reliably increases sales performance by 2-5%.But here’s where it gets interesting.Producers who are coached weekly show a 9% sales improvement and those leaders who coach several times per week or daily see a 17% improvement in their salespeople.What drives this improvement?

The regularly coached Producer take 34% more Responsibility and are 19% more Motivated.That means they don’t blame anyone but themselves when things aren’t going their way and they actually WANT things to change.

Is coaching a blindspot for you?

here are some questions to consider:

Am I coaching my Producers enough? At least weekly, if not daily.

Do I try to rescue my people? When they have problems, am I asking them questions so they arrive at the answer instead of just giving them solutions?

Am I asking enough questions? Am I helping them remove the noise and distractions so they can see the real challenge? Or am I letting my coaching turn into venting sessions where office politics, annoying clients, and external factors are getting blamed?

By the end of a coaching session, am I getting a commitment from my Producer? Are they agreeing to take an action by a certain date? Or does the time come-and-go with no change or commitments?

Am I following a coaching framework or process? Or am I just shooting from the hip? Am I leaving a 1:1 meeting feeling like nothing was accomplished?

Agency Management

Blind Spot #2 – Motivating

In general, there are 3 categories of motivation: Extrinsic, Intrinsic, and Altruism.Extrinsic motivation is the type of motivation that comes from the outside. Things like money, rewards, toys, vacations, and material things.A Producer might be Extrinsically motivated if they

---> Dramatically increase their sales activity 2 weeks before the end of a quarter.

---> Constantly bring up how "unaffordable" everything is these days.

---> Suffer from shiny object syndrome and chase all kinds of risks, including really small ones or ones they shouldn’t really be writing at all.Intrinsic motivation comes from inside the person. Most commonly: recognition, fulfillment, satisfaction, enjoyment, love of their work, mastery, or having something to prove to others.And finally, altruists. These people are motivated to serve others at a cost to themselves. They put client needs or the needs of their teammates over and above the company’s needs.

Motivating may be a Blind Spot for you if you treat all Producer problems as solvable by commissions and financial incentives.What is most misleading here is that Financial Incentives CAN and DO work for all 3 types of Producers, BUT will only work temporarily for the Intrinsics and the Altruists.If you treat money like a blunt instrument to grow your book, it may work for a week, a month, or even a quarter. But after enough time, the Intrinsics and the Altruists will return to their normal behaviors.

Is motivating a blindspot for you?

here are some questions to consider:

Do I know how my people are individually motivated, am I just guessing, or am I clueless?

Do I try to motivate everybody the same way or do I individualize the motivation strategy?

When a new behavior or process is implemented, do my people adopt it or do they resist without expressing why?

Agency Management

Blind Spot #3 – Recruiting and development

We have a talent crisis on our hands. You feel this crisis when a staff member gives you a two-week resignation notice and you hit the job boards to look for a replacement.

Many industry reports predict that over half of the insurance industry is looking to retire in the next 15 years.

Less than 25% of the industry’s workforce is under the age of 35.

83% of agents quit within the first 3 years.

When applicants come in, IF they come in, they’re from underqualified or worse yet, obviously unmotivated candidates.

When applicants come in, IF they come in, they’re from underqualified or worse yet, obviously unmotivated candidates.Again, this is not your fault. You inherited the talent market we’re in and the norms of the industry.But you can overcome this blind spot by changing how you Attract, Screen, Interview, Select, Onboard and TRAIN your people.

Attract: most job ads are boring! To draw in high performers, you need to EXCITE them.

Screen: Do you really know what you’re looking for in an ideal candidate?

Interview: Turn the interview into an audition! Find out how that Producer will behave in front of a real life prospect or client.

Select: Use data, not emotions. Honest Agency Managers will admit they use their gut. Use a scientific approach instead.

Onboard: If you don’t have a 30-60-90 day ramp up plan for your new hires, they are destined to fail. And the cost of 1 bad sales hire? 3x-5x their annual income.

Train: If you only train on products and systems, can you really expect good production? Your people need to be trained on what to know, say, do, and show to be successful in sales.

Is recruiting and development a blindspot for you?

here are some questions to consider:

Are my job ads boring? Does it just list the duties and responsibilities without appealing to higher level needs like prestige or legacy?

Are my interviews too nice? Do I apply enough pressure to expose strengths and weaknesses or do I let the candidate get too comfortable? Are my interviews auditions or just walking through the resume?

Is my selection process driven by objective reasoning or my gut? Do I let my desperation impact my decision-making?

Do I have an onboarding plan? If I do, does my onboarding set up the Producer to be transactional or strategic? Do I have a 30-60-90 day plan and set of expectations?

Am I developing my Producers? Are they learning and mastering the basics? Or are they flying blind?

What You Can Do About Your Agency Management Blind Spots

You’re not alone. If any of this resonates with you it’s because I have walked down this road with people just like you before.It’s why I developed the Superstar Agency Sales Blueprint.

A field-tested 90-day guided action plan to transform your sales culture from zero to hero. For good.

meet the 90-day superstar agency sales blueprint

The four step transformation project that will create a permanent sales culture in your agency.

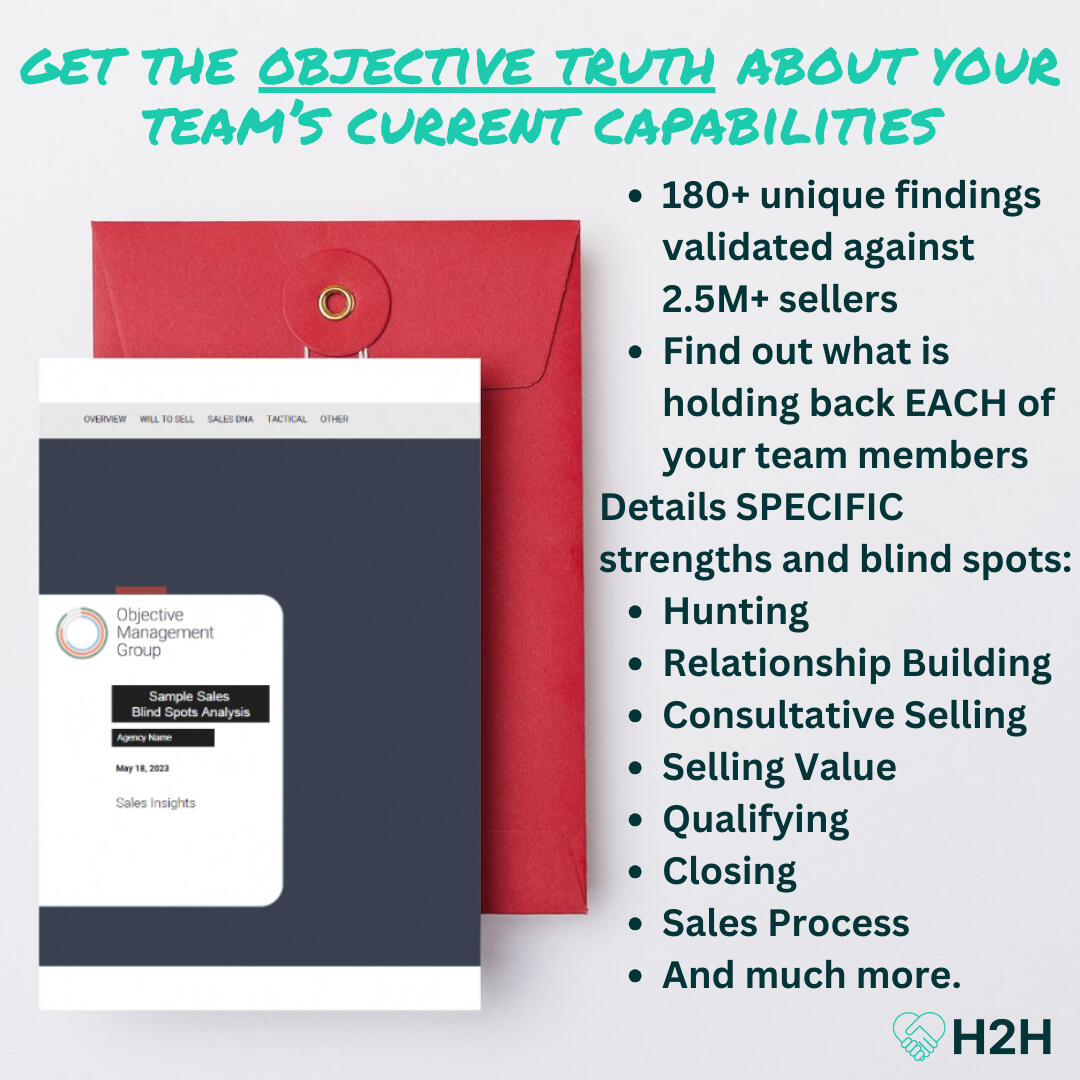

STEP 1: blind spot assessment

Assess you and your Producer team with the Agency Manager and Producer Blind Spot Analysis.

180+ unique findings to SCIENTIFICALLY identify all the strengths, weaknesses, and blind spots for everyone on your team.

92% predictive. When used on a new hire, the Blind Spot Analysis can predict whether that person will be your lowest performer or fired within 6 months with 92% accuracy.

Since 1996, over 2.5 MILLION salespeople and their managers have been assessed.

STEP 2: personalized training

Train your team with live workshops targeted at their specific Blind Spots.

You may think your team has a Prospecting problem. But every Producer who is scared to pick up the phone is scared for different reasons.

Get to the root cause of why your Producers don’t do what they’re supposed to and give them EXACTLY what they need to change forever.

During and after the 90-day program, your entire team will know exactly what to say, do, and show to grow their books of business.

STEP 3: action plans

Avoid the “training trap” where people learn something but never apply it.

Each team member (and you) gets a personalized action plan based on your Blind Spots Analysis.

The action plans are fun, personalized, and provide a sense of accomplishment while activating what they learned in the training.

No more training without results. Progress is mandatory.

STEP 4: coaching and accountability

Eliminate excuses by keeping you and your team accountable to the action plan

I coach you each step of the way and help you become a powerful leader and sales coach.

Everything I do with you and your team will be transferred to you so you can keep making progress until the day you retire.

Instant messaging support and group coaching calls with your team to answer their questions and give them the help that they need. No more excuses.

Weekly reports so you know EXACTLY who is making progress and how fast changes are happening.

Don’t take it from me.

Here’s what one Agency Owner and his staff had to say after graduating from the Superstar Agency Sales Blueprint.

Richard's story

lacey's story

Why H2H? Who's David?

“The worst part about selling insurance is that the only real training you get is on product…then you’re stuck trying to sell something you only half-understand to clients who don’t have the time, patience, or desire to learn something technical. It sets up the young and hungry insurance sales professional for failure.”I learned on the first day of the job that no one else in the room had planned to become an insurance seller…it just sort of happened.I had four very different lives in my insurance sales career: High-volume call center insurance representative, broker, brick-and-mortar agency associate, sales coach and trainer. I made every mistake you could possibly think of and paid dearly for it but experimented my way to becoming one of the best producers in a nationally top-performing agency.I temporarily left the industry from 2019-2023 to formally study sales from industry experts with decades of experience and then join a sales consulting company. After discovering what the top sales performers did in other industries to sell more and faster, I started delivering these ideas and techniques to the insurance industry.

This passion project turned into H2H.

We believe that at the end of the day, sales is not Business-to-Consumer (B2C) or Business-to-Business (B2B). Sales is the art and science of one human connecting the resources that another human needs to improve their lives (human-to-human).Our training library, which you will get access to, covers every thinkable stage of the insurance selling journey. Everything that an agency needs to know, say, do, and show to attract, delight, and win more clients at your fingertips!

Isn’t it time to finally enjoy the freedom a successful insurance sales career has to offer?

It’s true that no one is coming to save you. Your team’s success is up to you.Your clients need YOU to be the BEST LEADER you can possibly be so they can feel confident that the people and assets they care most about are protected.By making a single investment in your agency’s sales culture, you can be the insurance professional your community needs, the team leader your producers trust, and the financial provider your family can depend on.Make missing targets, working late nights, and wondering about your career legacy a thing of the past.Take control of your sales team.Take control of your book.Take control of your career, life, and financial freedom.Isn’t it time to make good on the promise you made yourself when you jumped into the role?Isn’t it time to make it fun again?Book your personal free consultation with David to see if the Superstar Agency Sales Blueprint (SAS Blueprint) is the right fit for you.

What Other Insurance Sales Leaders and Producers Have Said About Working with David

now is your time to book your free personal consultation with david.

10 Reasons You Should Avoid The Superstar Agency Sales Blueprint (SAS Blueprint)

As attractive as this offer is, there is a number of people who will leave without investing in the 90-day program. Although that's okay with us from a business standpoint, it still bothers me personally.You see, I know how much Insurance Sales Leaders benefit from it. I read their reviews; I talk to them on the phone; I visit and see them personally. So often they tell me that they've "completely changed our agency’s sales culture!" Because of this, I just hate the thought of someone not getting the SAS Blueprint due to some error or omission in our explanation.That's why I held a special brainstorming session with a group of our people just to try and figure out why you might say "no" to the SAS Blueprint. After several hours, our group came up with a few possible reasons.Here they are:

I don't think this system will really help my team find more clients and sell more insurance.

A system is its most effective if the person is willing to implement it. The good news for you is that most salespeople only need to learn 1 or 2 new ideas to unlock a whole new level of sales success. And the coaching and accountability part of the SAS Blueprint makes your job a heckuva lot easier.I am too busy (or my team is too busy) to go through the exercises or use the training program.

Insurance salespeople are busy. That’s why much of the content has ready-to-go scripts that you can start using right away with 0 modifications. Just copy-and-paste into an email or open the file and read it word-for-word to a client. Remember, this is BY insurance sellers FOR insurance sellers.I don't know what kind of results to expect.

You will have a done-with-you training system that your team can use to improve their skills without you spending all of your time managing them. Recent clients have been able to get their team from spending 100% of their time on client service to consistently prioritizing sales and filling their calendars with new appointments.I've done sales training before and it didn't make a difference.

Most sales training is too general to know how to apply it to selling insurance. And most insurance industry sales training is outdated or too basic.

The SAS Blueprint combines the best ideas, principles, and techniques that top-performing salespeople use and directly applies them to the insurance context.

On top of that, the Blind Spot Analysis will ensure that the program is 100% relevant to each team member.I don't think David has enough industry-sales experience.

There is a difference between having 20 years of experience or having 1 year of experience 20 times. So many agents and producers do the same thing for years and get the same mediocre results quarter-after-quarter, year-after-year. These people have 1 year of experience that they keep reliving again and again like it's Groundhog Day.

Thankfully, despite my mistakes, I have intentionally experimented, researched, and learned from countless experiences. Some of them through the natural course of business, others because I seek it out with the purpose of overcoming what other sellers fear. There are many questions I have answered that leave "experienced" sellers dumbfounded.I need to see ROI before I spend any money.

Since commission plans are different based on product and company, here is an illustrative number to demonstrate your ROI. If you make a 15% commission on a new sale, a $2,000 sale will earn you $300. If you make 5 additional sales per Producer, congratulations - you basically just broke even. Everything above that is gravy.

Of course, this doesn’t consider the residual commissions or “trailers” you will make every year after.

Depending on the size of your sales team, this amount can be multiplied many times.

Of course, I am confident you will make many, many more sales than the examples listed above. But rest assured that the investment in the SAS Blueprint will have huge impact on your earning potential.I don't need this, but my new hires do. Will this work to train new hires?

Absolutely. This is one of the quickest and most effective ways to get new hires up and running. You will be further ahead than your competitors and make fewer mistakes in the onboarding process.I might buy it but then regret it after.

You will love what you see and get value from it. But, in the off-chance that you don’t see the value for whatever reason, there is a 30-day partial money-back guarantee. It’s partial because a large % of the investment goes into the Blind Spots Analysis, which is intellectual property that I need to pay for. Beyond that, no questions asked.I don't think it will be easy to see results.

It’s simple, but it’s not easy. Make no doubt about it, it takes work to improve your coaching skills and the team’s behaviors. But if you follow the techniques and processes, your team will be more successful and sell more insurance. How much more? That is up to you and your commitment level. The coaching and accountability in the SAS Blueprint makes it almost impossible to NOT see results.I think I should have a trial first before committing to the full SAS Blueprint.

I agree. During your call with me, we can talk about doing a pilot first. This would involve doing 1 or 2 Blind Spot assessments and receiving a tailored action plan. If Those Reasons The SAS Blueprint No Longer Apply To You, It’s Time To Book Your Free Consultation.

If Those Reasons To Avoid The SAS Blueprint No Longer Apply To You, It’s Time To Book Your Free Consultation.

Stop letting your underperforming team control the fate of your book. Take control of your book, finances, and legacy. For good.

P.S - This comprehensive insurance sales program is the only one of its kind in the market and the sooner you get your consultation, the faster you will start attracting, delighting, and winning more clients.

Welcome to the Ultimate Insurance Sales Playbook Collection.

Ready to remove every barrier to hitting your targets?

Click the tiles below to access your new sales success assets.

Privacy PolicyEffective Date: June 21, 2024H2H Group ("we", "us", "our") is committed to protecting your privacy. This Privacy Policy explains how we collect, use, disclose, and safeguard your information when you visit our website [yourwebsite.com] (the "Site"). Please read this privacy policy carefully. If you do not agree with the terms of this privacy policy, please do not access the site.Information We CollectWe may collect information about you in a variety of ways. The information we may collect on the Site includes:Personal Information:Name

Email address

Phone number

Any other information that you voluntarily provide to us

Non-Personal Information:Browser type

Language preference

Referring site

Date and time of each visitor request

How We Use Your InformationWe may use the information we collect in the following ways:To operate, maintain, and improve our website and services

To respond to your inquiries, questions, and/or other requests

To send you marketing communications

To comply with any applicable laws and regulations

Disclosure of Your InformationWe may share information with third parties when you explicitly authorize us to share your information.Security of Your InformationWe use administrative, technical, and physical security measures to help protect your personal information. While we have taken reasonable steps to secure the personal information you provide to us, please be aware that despite our efforts, no security measures are perfect or impenetrable.Policy for ChildrenWe do not knowingly solicit information from or market to children under the age of 13. If we learn that we have collected personal information from a child under age 13 without verification of parental consent, we will delete that information as quickly as possible.Changes to This Privacy PolicyWe may update this Privacy Policy from time to time in order to reflect, for example, changes to our practices or for other operational, legal, or regulatory reasons.Contact UsIf you have any questions about this Privacy Policy, please contact us at:david@h2hgroup.co